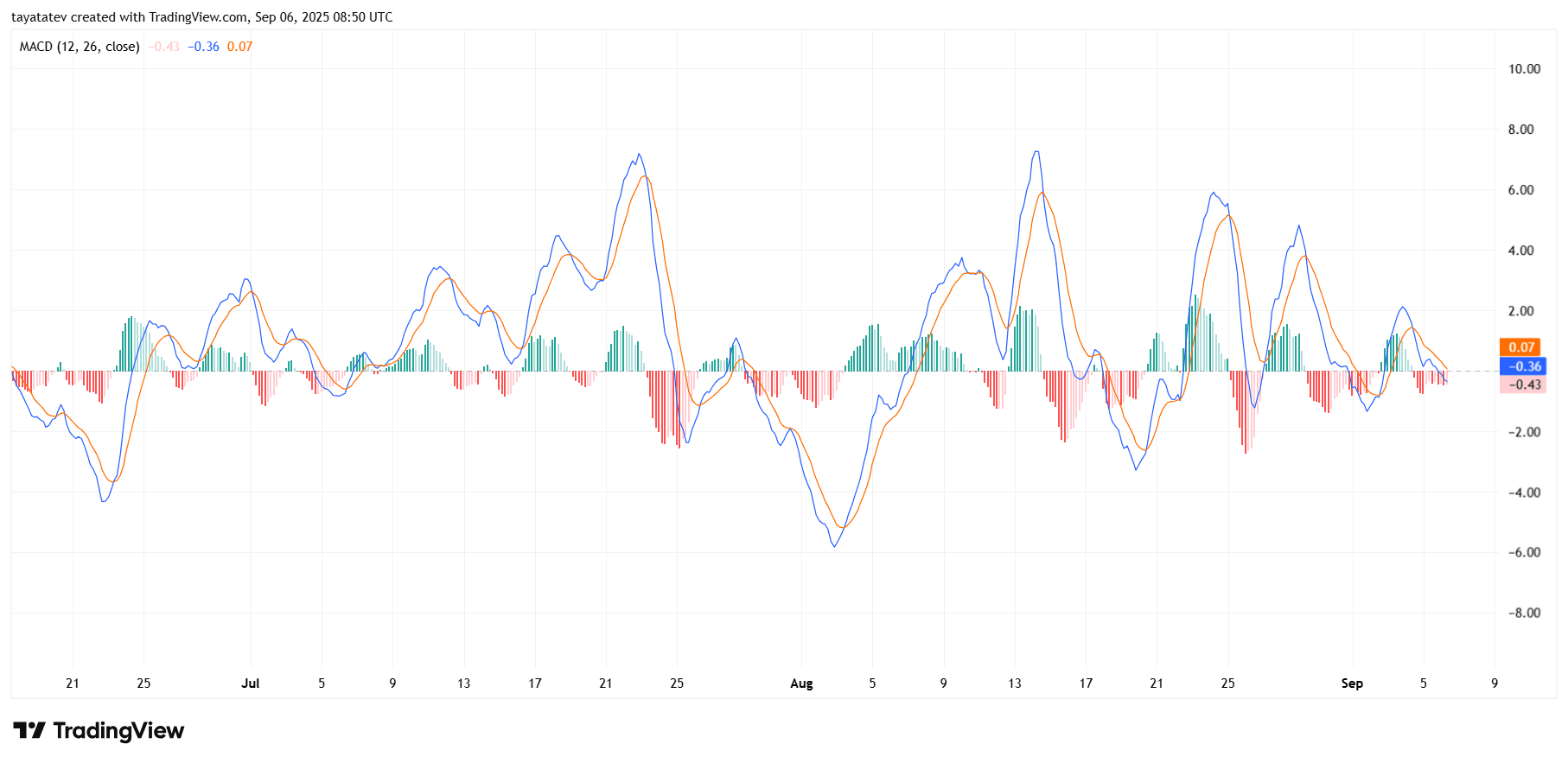

Solana developers launched the Alpenglow upgrade, designed to reduce block finality to 150–200 milliseconds. This change makes Solana faster for decentralized applications and Web3 services. The network now processes confirmations at near-instant speed, strengthening its position among high-performance blockchains.

Institutional Investors Expand Solana Holdings

On September 4, 2025, DeFi Development Corp. announced via a press release on GlobeNewswire that it acquired 196,141 SOL, bringing its total treasury holdings to 2,027,817 SOL, valued at approximately $427 million. All newly purchased tokens are intended for staking across both the company’s own validators and external ones to generate native yield.

SOL Strategies Secures Nasdaq Listing Amid Revenue Growth

SOL Strategies Inc., a treasury management firm focused on Solana assets, confirmed that its shares will begin trading on the Nasdaq Global Select Market on September 9, 2025, under the ticker STKE. This approval marks a step up for the company, which previously traded on the Canadian Securities Exchange (CSE) under the symbol HODL and on the OTCQB market in the United States under CYFRF. Existing OTC shares will automatically convert into Nasdaq-listed shares.

The Nasdaq listing aims to increase institutional visibility and provide shareholders with improved liquidity. By joining one of the world’s most selective equity markets, SOL Strategies positions itself to attract a broader pool of investors, including funds restricted to U.S. national exchanges.

At the same time, the company highlighted strong financial momentum. Quarterly revenue reached $8.7 million in Q2 2025, compared with just $3.5 million in the last quarter of 2024. According to its filings, the firm manages a treasury of approximately 435,000 SOL, valued near $89 million at current market levels. These holdings are deployed across staking operations and validator infrastructure to generate yield from Solana’s network activity.

SOL Strategies stated that the Nasdaq debut will not affect its Canadian listing on the CSE, which it intends to maintain. However, it will voluntarily delist from the OTCQB, citing Nasdaq’s deeper liquidity and stronger institutional investor base as the main drivers for the move.

The transition underscores the growing role of Solana-based treasury management in global finance. By aligning itself with Nasdaq’s Global Select Market, SOL Strategies gains access to one of the highest-tier exchanges, signaling a bid to compete at a new scale while offering traditional investors regulated exposure to Solana’s expanding ecosystem.

Solana’s Network Value Increases

Solana’s decentralized finance ecosystem has reached a new milestone, with its Total Value Locked (TVL) climbing to nearly $11.7 billion, according to data from DeFiLlama. This figure places Solana among the top three blockchains for DeFi activity, behind only Ethereum and Tron. The steady growth reflects expanding participation from both retail users and institutional players.

Transaction volumes remain a key driver of this momentum. Solana processes more than 65 million daily transactions, supported by its high-throughput architecture and low fees. These numbers consistently outperform most rival networks, highlighting Solana’s role as a hub for decentralized exchanges, liquid staking protocols, and on-chain applications. Rising developer activity also contributes to this performance, as new projects continue to deploy on Solana and attract liquidity.

Solana’s position in the DeFi landscape has also been reinforced by liquid staking protocols such as Marinade Finance and Jito, which account for a substantial share of locked value. These platforms provide new yield opportunities and enhance liquidity, attracting both individual and institutional participants. As adoption spreads, Solana’s share of DeFi activity has steadily grown, signaling that the network is not just maintaining momentum but expanding its reach across the broader blockchain economy.

Research Targets Solana Phishing Attacks

Security researchers unveiled SolPhishHunter, a specialized tool designed to detect and analyze phishing campaigns targeting Solana users. The system monitored blockchain activity and flagged malicious patterns, identifying more than 8,000 phishing incidents across Solana’s ecosystem. According to the study, these attacks resulted in nearly $1.1 million in stolen assets, underlining the scale of the threat facing retail participants.

The research team compiled their findings into the first dedicated phishing dataset for Solana, which will be made available for the wider security community. By sharing this resource, developers and auditors gain the ability to test protective measures, improve wallet warnings, and create more secure interfaces for decentralized applications.

In parallel, other studies have highlighted vulnerabilities in Solana smart contracts, showing that as adoption grows, so do attack surfaces. Researchers are actively working to identify weaknesses in contract design, with the goal of strengthening code audits and preempting exploits. This effort reflects a wider movement in blockchain security: as Solana’s user base expands and institutional participation deepens, proactive defense mechanisms become essential to preserving trust.

Together, these initiatives point to a maturing ecosystem where speed and efficiency—hallmarks of Solana’s design—are being paired with stronger protective layers. By integrating tools like SolPhishHunter and addressing contract-level risks, the network aims to balance innovation with resilience as it continues to scale in decentralized finance and beyond.

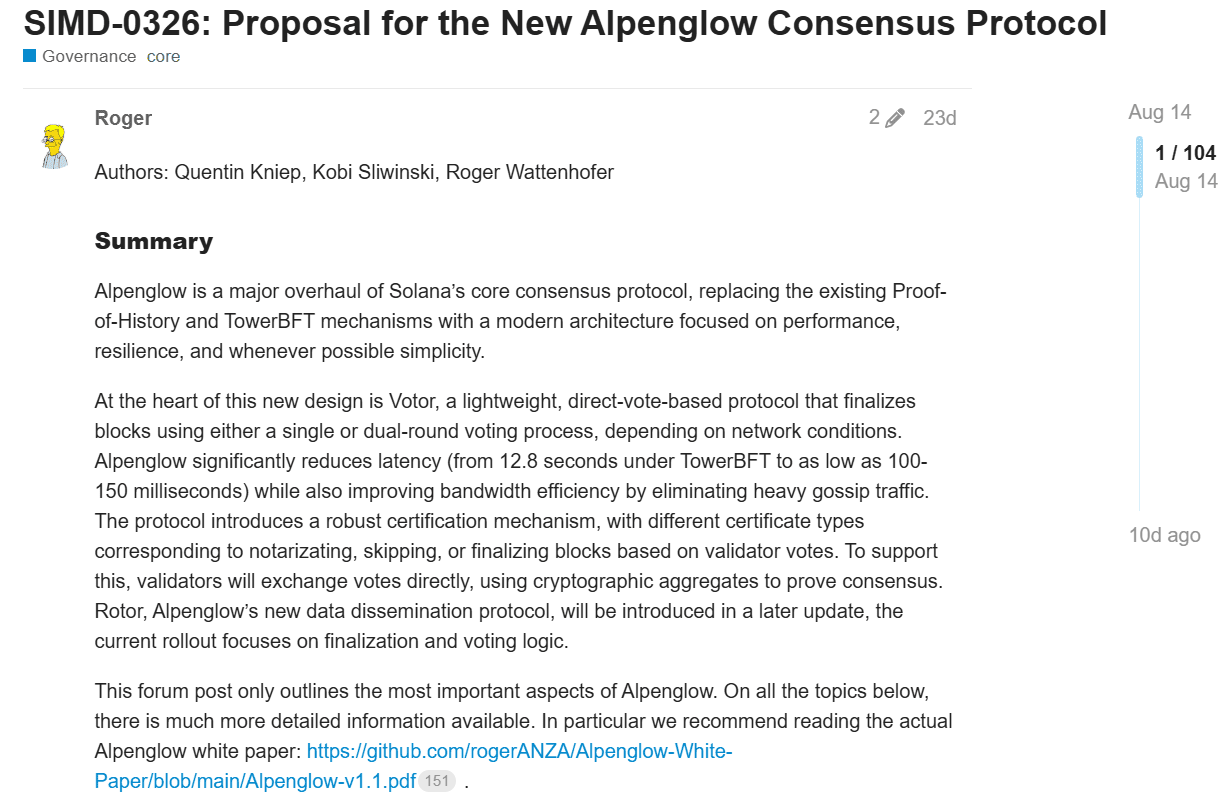

Solana Chart Analysis – September 6, 2025

This Sol/USD four-hour Solana chart, created on September 6, 2025, shows the price trading around $203 while forming a clear rising wedge pattern. A rising wedge pattern occurs when both support and resistance lines slope upward, but support rises more steeply, creating a narrowing structure that signals a potential breakout or breakdown.

In this case, Solana has pressed against resistance near the $220 zone several times while respecting the upward-sloping support trendline. The pattern suggests tightening price action, with pressure building for a decisive move. If the breakout confirms, the measured move from the wedge points to a potential upside target of about 38% higher from current levels, placing Solana around $282. This target is drawn from the prior impulse move and the height of the wedge, projected upward.

The presence of the 50-period EMA near $204 shows the market is consolidating above an important technical support. Strong transaction volume spikes around resistance indicate accumulation rather than distribution, which supports the bullish outlook. With the wedge nearing its apex, Solana’s next move will likely define its short-term momentum. If buyers maintain control and push beyond $220 with sustained volume, the probability of reaching the projected $282 level increases significantly, reinforcing the view that Solana could extend its role as a leading high-performance blockchain in the current market cycle.

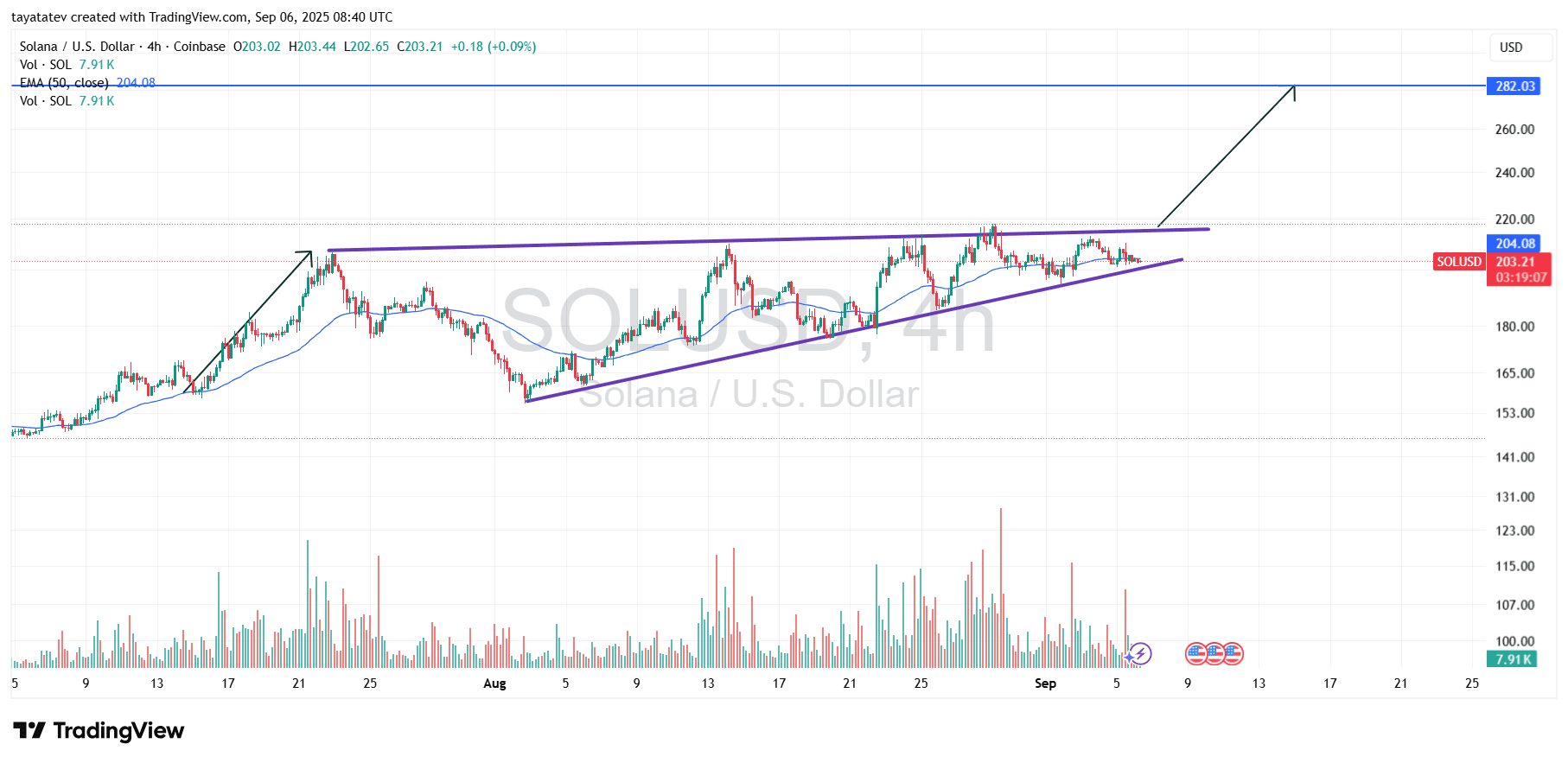

Solana RSI Analysis – September 6, 2025

This chart shows Solana’s Relative Strength Index (RSI) on the four-hour timeframe, recorded on September 6, 2025. The RSI is currently near 46.6, with its moving average around 48.2. The index sits in the middle of the 30–70 neutral range. This position signals that Solana is neither overbought nor oversold, but instead consolidating after recent volatility.

The sideways movement in the RSI, with repeated touches near 60 and 40, highlights indecision. Buyers have attempted to push momentum higher several times, but sellers have forced quick pullbacks. Transitioning into September, this balance between forces reflects the tightening wedge pattern visible on the price chart. A breakout in price would likely push RSI sharply upward, potentially testing levels above 70 if bulls gain control.

At the same time, RSI dipping under 40 in the past weeks showed that sellers remain active. If the index falls again below that level, momentum could shift against bulls, creating risk for a deeper correction. However, the current alignment of the RSI and its moving average suggests stabilization, not weakness. This gives Solana room to build pressure before its next significant move.

By combining this neutral RSI with the rising wedge structure, the chart suggests an environment where momentum can swing strongly once confirmation appears. Traders are watching for a clear shift above 60 on RSI as a sign of renewed strength, or a drop below 40 to confirm weakness. Until then, consolidation continues with energy stored for the next decisive move.

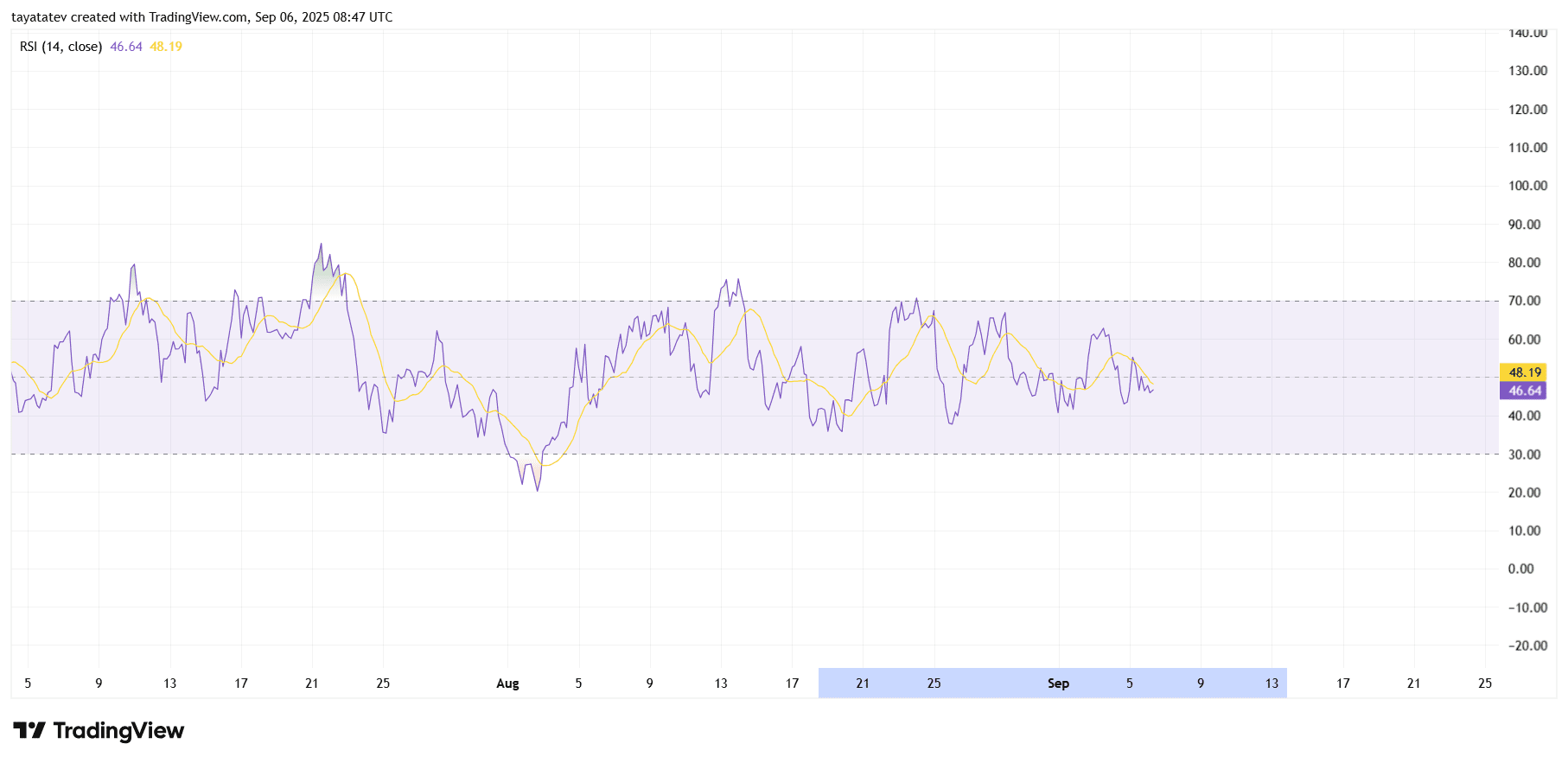

Solana MACD Analysis – September 6, 2025

This chart presents Solana’s MACD (12, 26, close) on the four-hour timeframe, recorded on September 6, 2025. The MACD line sits at -0.36, while the signal line is slightly higher at -0.43, leaving a narrow positive histogram reading of 0.07. This alignment shows the market is hovering near equilibrium, with neither side holding strong momentum.

The chart reveals several sharp swings over the past months, where the MACD crossed decisively above or below the signal line. Each cross was followed by strong moves in price, confirming that Solana remains highly reactive to momentum shifts. Currently, the two lines are close together and moving sideways, reflecting consolidation after volatility.

Transitioning into September, the histogram has flipped between green and red multiple times, signaling indecision. Bulls and bears continue to battle without a clear advantage. However, the narrowing gap suggests a larger move may be approaching. If the MACD line climbs above the signal line with expanding green bars, bullish momentum could strengthen quickly, supporting the breakout potential suggested by the wedge pattern on the price chart. Conversely, a downward cross with widening red bars would confirm renewed selling pressure and warn of a correction.

In summary, the MACD shows that Solana is in a neutral but coiled state, where momentum is balanced but primed for expansion. The next confirmed cross, supported by volume, will likely determine whether Solana sustains its push toward higher targets or slides back into deeper consolidation.