Bitcoin (BTC) price traded near $111,500 after early September swings saw the prime crypto trying to start a rally. Traders’ arguments continued over whether the recent price structure pointed toward another expansion or a deeper correction. Onchain metrics signaled firm liquidity support. On the other hand, technical analysts described price action as the final stretch of accumulation before a potential breakout above $112,500.

A few predictions have Bitcoin price surging to $190,000 and beyond, by late Q4 2025 or early 2026.

On-Chain Signals Highlight Bitcoin Accumulation With Stablecoin Firepower

Bitcoin’s on-chain structure reflected conditions often seen near pivotal points, with several analysts framing it as a setup for expansion.

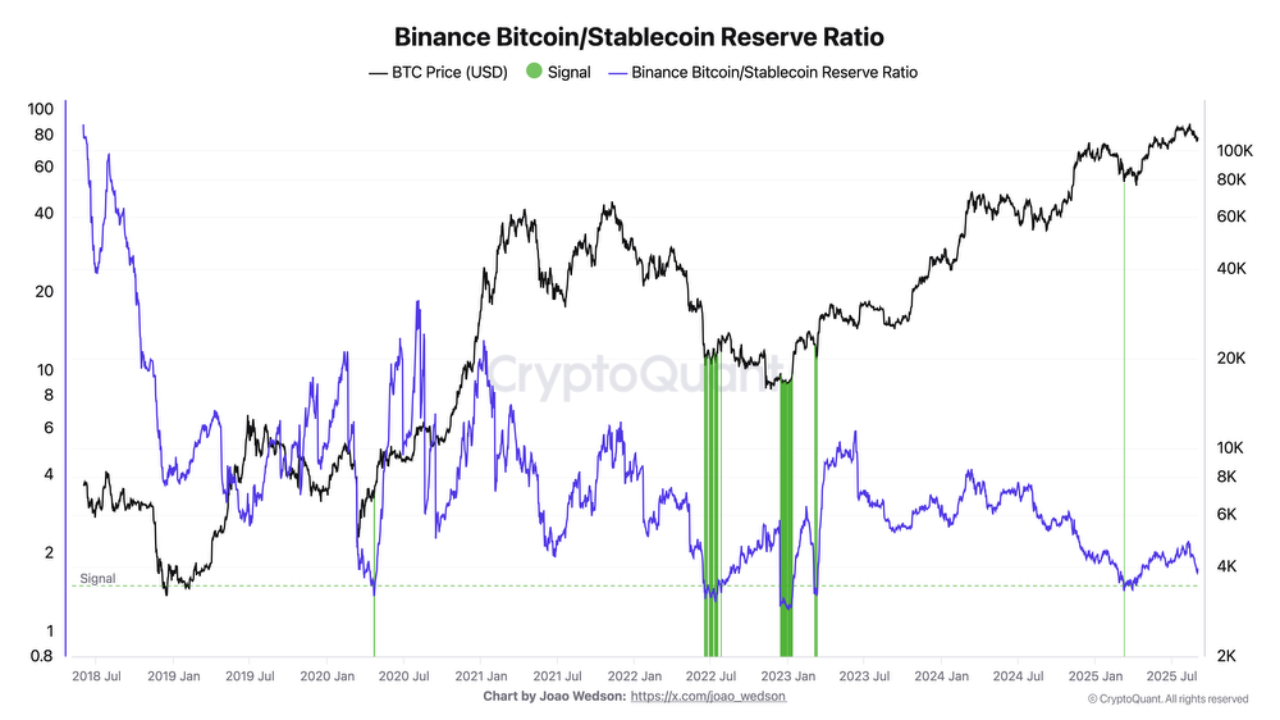

Darkfost pointed to Binance’s BTC-to-stablecoin reserve ratio, which dropped toward one as stablecoin balances reached a record $37.8 billion. The analyst noted that similar readings previously aligned with accumulation phases, including March’s rally from $78,000 to a fresh all-time high. The unusual factor was that this signal usually appeared during bear markets, raising questions about its reliability at current levels.

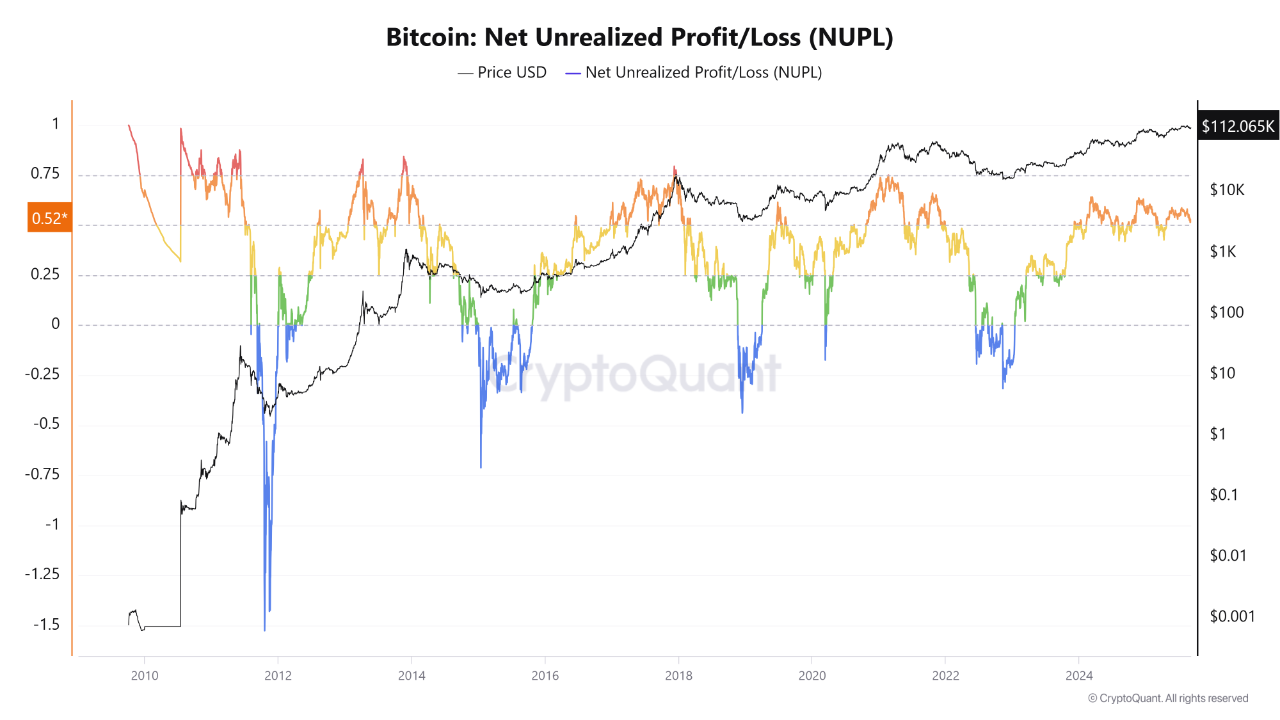

Another analyst, PelinayPA, shared a CryptoQuant post, underscoring the broader cycle context through the Net Unrealized Profit and Loss ratio, which stood at 0.52. That placed Bitcoin in the “faith and optimism” zone, historically seen as mid-bull. The analyst argued that this left room for continuation toward $120,000 to $150,000, though the indicator also suggested holders might take profits soon.

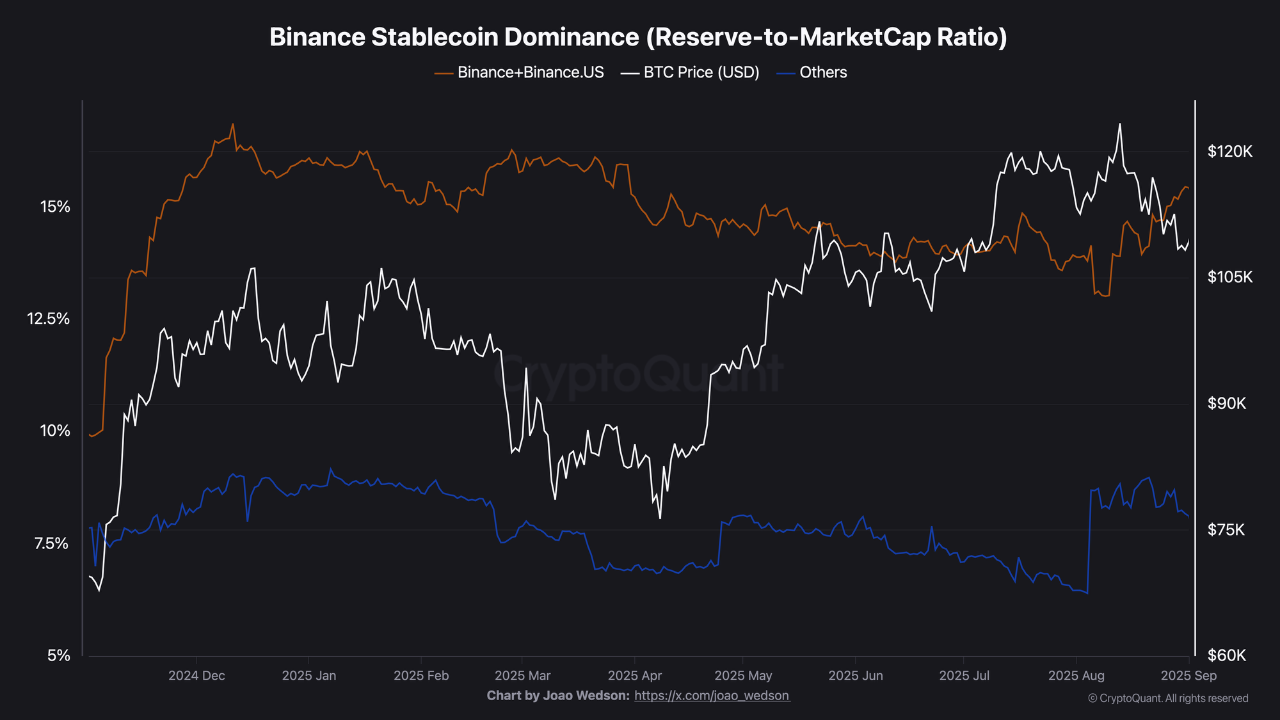

Moreover, BorisD added another layer, highlighting how Binance’s share of stablecoin reserves continued to climb even as other exchanges saw declines. The analyst stressed that the concentration of liquidity on a single platform could act as a decisive driver if deployed, but he also marked $105,000 to $107,000 as a zone that needed to hold.

The combination of record stablecoin reserves, mid-cycle sentiment, and exchange-specific dominance implied that the prime crypto had the liquidity and structural base to push higher. At the same time, the overlapping signals of profit-taking risk and critical support meant volatility remained a feature of the market, leaving expansion possible but not assured.

The backdrop also shifted with the Nasdaq debut of American Bitcoin, a mining and treasury firm backed by President Trump’s sons. Listed under the ticker ABTC, the stock jumped as much as 110% before closing with mid-teen gains, valuing the company at about $7–8 billion.

The firm already holds more than 2,400 BTC and has announced plans for a $2.1 billion equity raise to expand both its mining operations and Bitcoin accumulation. The listing added fresh institutional weight to Bitcoin’s market standing, even as its short-term direction remained undecided.

Technical Analysts Frame Expansion Phase With Cycle Targets

Meanwhile, technical analysts treated Bitcoin’s structure as near the end of accumulation, with price preparing for a decisive move.

ZYN mapped the phases of manipulation and expansion, arguing that the current range resembled a late-stage build-up. He placed $112,500 as the level that, once cleared, would confirm an expansion phase for the BTC USD pair. The analyst claimed that the pattern aligned with historical cycle setups where prolonged sideways periods preceded directional surges.

X-based analyst CryptoElites shared a similar sentiment, presenting a stair-step model where each breakout extended Bitcoin’s range higher. The post projected a broader move toward $190,000, noting that cycles often stretched far beyond the midpoint once momentum turned.

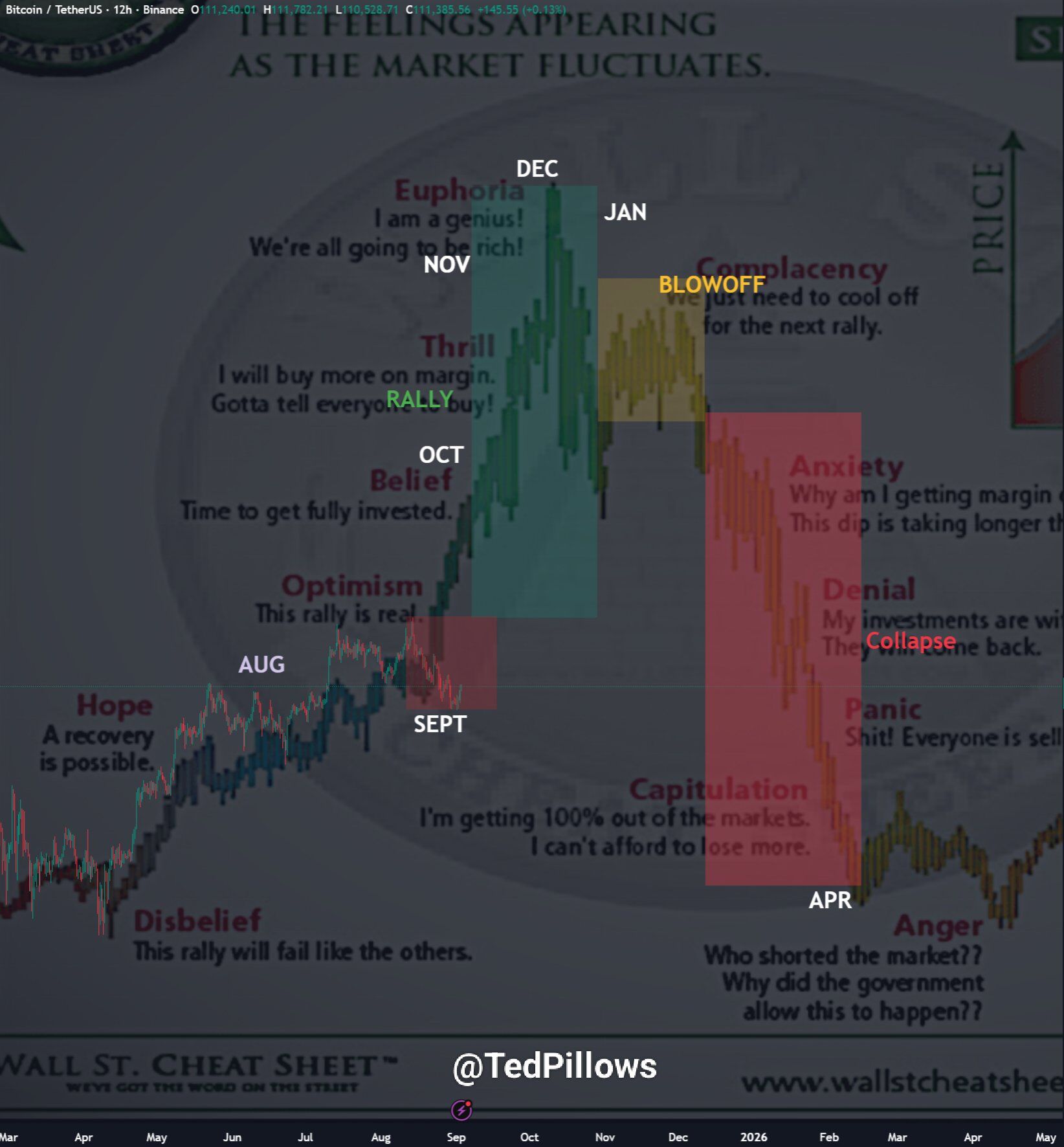

Ted tied the discussion to the broader market psychology, linking recent price action to the Wall Street Cheat Sheet cycle. The analyst suggested September could remain uneven, consistent with past cycles that saw muted trading before expansion phases. According to the X post, projection placed a potential blow-off top in late 2025 or early 2026, matching the extended timelines of previous bull markets.

Together, these perspectives reinforced the idea that Bitcoin had not exhausted its upside. The consolidation around $111,000 echoed past cycle pauses, where choppiness masked underlying momentum. Technical structures pointed higher, but the path likely involved volatility before the cycle played out toward its targets.