World Liberty Financial’s WLFI token faced heavy selling pressure within hours of its launch. On-chain trackers recorded insiders moving more than 216 million WLFI tokens, worth about $49 million, to centralized exchanges. One wallet alone transferred 53 million WLFI to Binance, a move widely seen as preparation for liquidation.

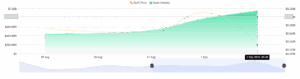

The sudden sell-off drove WLFI’s price down by as much as 55%, from early highs near $0.40 to $0.26. Within four hours, the project’s market capitalization fell by more than $2 billion, making it one of the sharpest post-launch crashes of 2025.

Traders on social media described the activity as a “blatant pump-and-dump.” Critics pointed out similarities to previous Trump-linked coins, where insider wallets quickly sold into launch-day liquidity.

24.67B Token Unlock Led the Price Drop and Derivatives Surge

The dumping coincided with WLFI’s first major token unlock. At launch, 24.67 billion tokens became eligible for circulation, far higher than the 5% supply figure originally communicated. While the team later clarified that only about 6.4% of tokens were “active,” this restriction was not enforced at the contract level.

Derivatives markets responded immediately. WLFI’s futures trading volume surged by 530%, climbing to almost $4 billion in 24 hours. Open interest also jumped to $932 million, reflecting a sharp rise in speculative positioning as traders bet on further volatility.

This activity suggests that market participants expected heavy selling pressure once locked tokens were released. The timing of the dumps reinforced those expectations.

Governance concerns now dominate discussion around WLFI. Investors argue that insiders hold too much influence, given that ecosystem funds, team allocations, and strategic investors control a large portion of supply.

The financing arrangement with Alt5 Sigma has also come under fire. The entity reportedly raised $750 million to buy WLFI, with up to $500 million in returns flowing back to Trump-linked entities. Analysts describe this as self-dealing, even if legally disclosed.

Such structures erode confidence in WLFI’s ability to function as a credible governance token. With insiders dumping into early liquidity, long-term holders face both supply dilution and weakened trust.

Senator Blumenthal Reviews WLFI Amid Trump Family’s $5B Holdings

The dumping has spilled into the political arena. U.S. Senator Richard Blumenthal has reportedly opened a preliminary review into World Liberty Financial, citing concerns that WLFI and related ventures could violate federal emoluments rules.

WLFI’s launch has boosted the Trump family’s paper wealth by more than $5 billion, surpassing real estate as their largest asset. Donald Trump holds about 15.75 billion WLFI tokens, valued near $3.6 billion, with family holdings estimated above $5 billion.

For Solana, which hosts both WLFI and its stablecoin $USD1, the launch delivered an initial liquidity boost. More than $53 million in $USD1 was deployed in Solana DeFi to support WLFI trading. But the sell-off has raised questions about the stability of those inflows.

If further insider selling continues, WLFI risks losing credibility as more than a short-lived trading vehicle. The project has already proposed a buyback-and-burn program, redirecting protocol fees to support token value. But such measures indicate the fragility of confidence rather than its strength.