South Korea’s FSC Chair nominee Lee Eog-weon said a future won stablecoin could operate on a national blockchain. He made the comment during a confirmation hearing when questioned by Democratic Party lawmaker Lee Kang-il.

Lee replied,

“Current stablecoins are issued on networks like Ethereum (ETH) and **Tron (TRX). You mean replacing them and developing a blockchain mainnet suited for Korea. I will discuss this possibility with relevant ministries.”

The proposal points to the government’s direction on stablecoins and blockchain policy. If carried out, it would be the first state-backed blockchain for stablecoins.

National Blockchain Debate for Stablecoin in South Korea

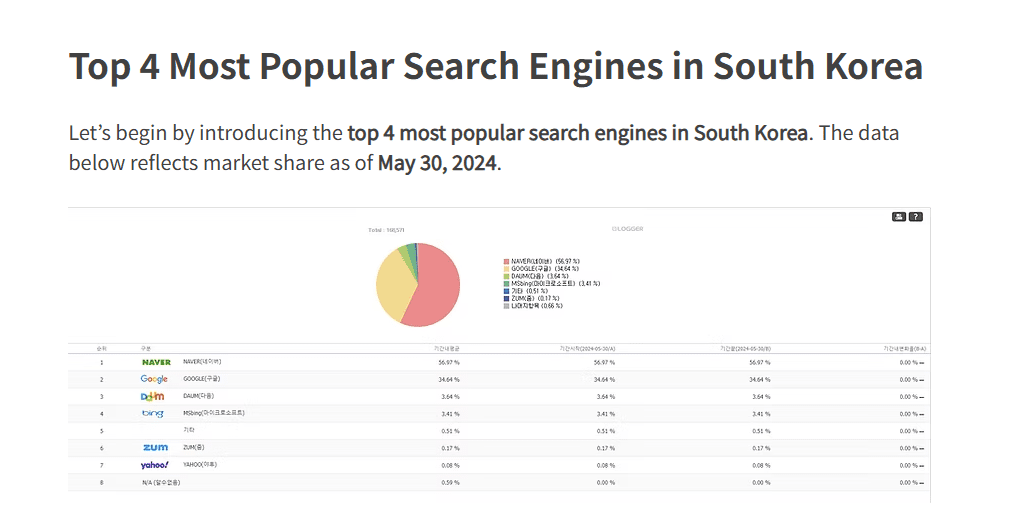

The concept of a national blockchain reflects growing debate in South Korea. Lawmakers and regulators say stablecoins need domestic oversight for monetary control. This follows South Korea’s pattern of preferring national systems, such as Naver over Google and KakaoTalk over WhatsApp.

Although the nominee did not provide technical details, he said he would review how blockchain could link to new industries. His remarks show that the FSC Chair nominee considers stablecoin infrastructure important for the country’s financial system.

Recent bills in the National Assembly address stablecoins but do not mention a national blockchain. International regulators demand reserve transparency and reporting from stablecoin issuers. South Korea’s debate is different because it raises the issue of blockchain nationality.

Ruling Party Supports Banks for Stablecoin Issuance

Democratic Party Floor Leader Kim Byung-kee spoke about stablecoin risks in a press conference. He said,

“At the very least, we will be cautious and conservative about getting ahead of the United States.”

Kim added that it is unsafe for crypto exchanges to issue financial products like stablecoins. He said, “It is very risky for (crypto) exchanges to issue financial products.” His view highlights the ruling party’s stance that banks should play the main role in stablecoin issuance.

According to Kim, a consortium model would work best. In this model, banks issue won stablecoins, while exchanges and other companies join as participants. This would rely on the banking sector’s stability and infrastructure.

South Korean Exchanges Focus on Stablecoin Partnerships

No South Korean crypto exchange has announced plans to issue its own stablecoin. Instead, major exchanges are focusing on partnerships. Upbit works with Naver Pay, and Bithumb cooperates with Toss, a local fintech platform.

These partnerships help exchanges handle stablecoin settlement services without becoming issuers. This matches the view of lawmakers who stress banks’ central role in financial oversight.

The Korea FSC Chair nominee’s remarks, along with the ruling party’s stance, show how South Korea may approach stablecoin regulation. The debate centers on banks, sovereignty, and the possible creation of a national blockchain for a won stablecoin.