Metaplanet’s Bitcoin strategy is under strain as the company’s stock price has dropped sharply. The Tokyo-listed firm’s shares have fallen 54% since mid-June, according to data cited by Bloomberg.

The decline comes even as Bitcoin gained about 2% during the same period. The drop has weakened Metaplanet’s fundraising model, which relied on higher share prices to unlock capital.

The company issued MS warrants to Evo Fund, its main investor, as part of its “flywheel” strategy. These warrants gave Evo an option to buy shares at fixed prices. With the stock falling, exercising those warrants has lost appeal, reducing Metaplanet’s liquidity and slowing its Bitcoin acquisition.

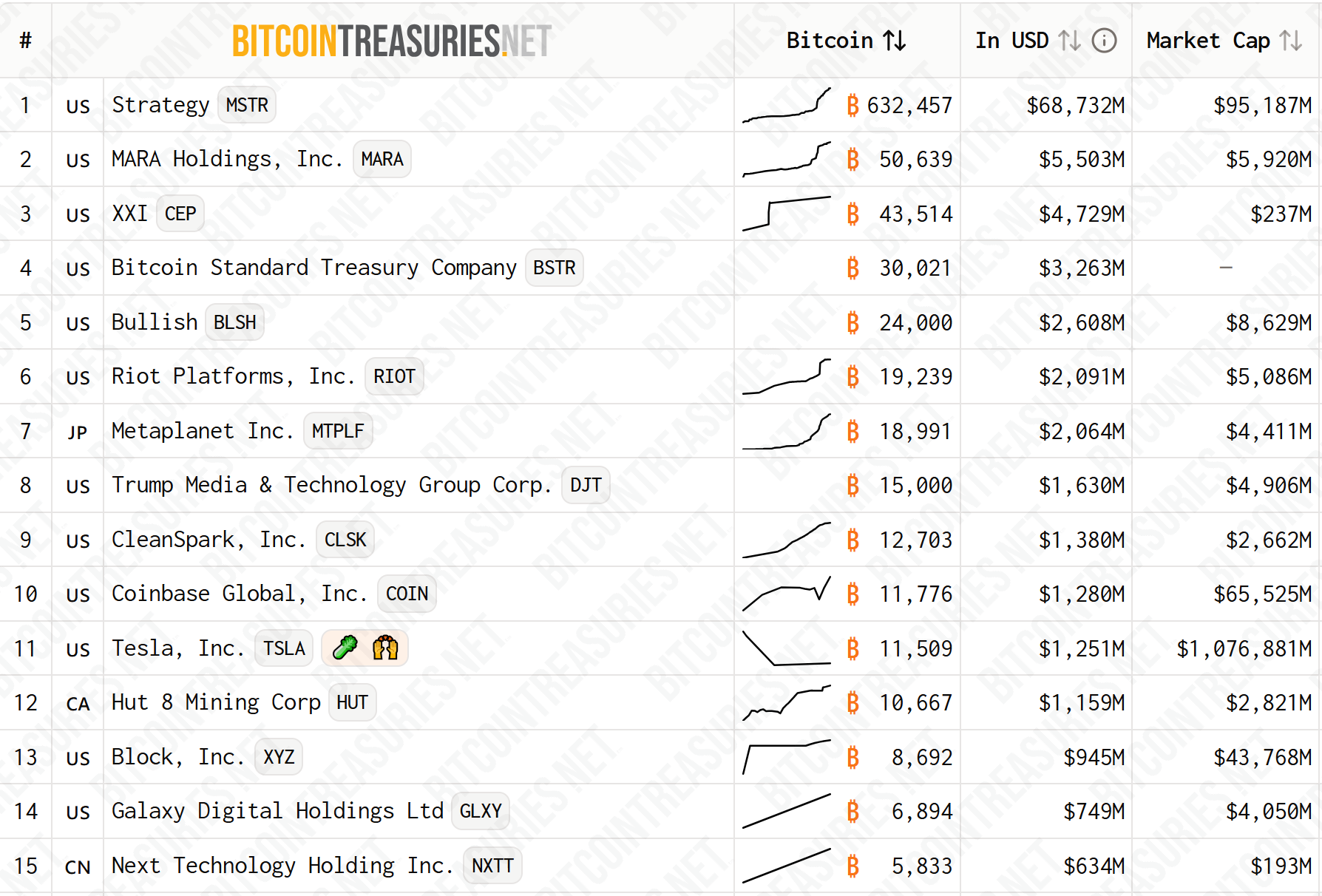

Led by Simon Gerovich, a former Goldman Sachs trader, Metaplanet has built a sizable Bitcoin position. The firm holds 18,991 BTC, according to BitcoinTreasuries.NET. This makes it the seventh-largest public Bitcoin holder worldwide.

The company has set ambitious targets despite current funding issues. It plans to hold 100,000 BTC by the end of 2026 and 210,000 BTC by 2027. These targets, if met, would make Metaplanet one of the largest Bitcoin treasury companies globally.

The Bitcoin holdings remain a central part of Metaplanet’s corporate strategy. However, its ability to expand depends on stable access to fundraising. With its share-based model facing limits, the company has begun seeking alternatives.

On Wednesday, Metaplanet announced plans to raise 130.3 billion yen ($880 million) through a public share offering in overseas markets. The move is intended to provide new capital after the slowdown in warrant-based fundraising.

Shareholders will also vote on Monday on a proposal to issue up to 555 million preferred shares. This step could generate as much as 555 billion yen ($3.7 billion). Issuing preferred shares is considered rare in Japan, which highlights the scale of Metaplanet’s fundraising efforts.

In an interview with Bloomberg, Gerovich described the preferred shares as a “defensive mechanism.” He explained that the design allows the company to raise funds without immediately diluting common shareholders if its stock continues to fall.

The planned preferred shares are expected to carry dividends of up to 6% annually. They will also be capped at 25% of Metaplanet’s Bitcoin holdings during the initial stage.

This connection directly ties the new fundraising instrument to the company’s Bitcoin treasury. It could also appeal to investors in Japan seeking fixed returns in a low-yield environment.

Metaplanet has suspended Evo Fund’s warrant exercises between September 3 and September 30. The pause clears the way for the issuance of preferred shares.

Declining Bitcoin Premium Creates Risk

Analysts have flagged risks to Metaplanet’s approach. Eric Benoit of Natixis said,

“The Bitcoin premium is what will determine the success of the entire strategy.”

That premium measures the difference between Metaplanet’s market value and the market value of its Bitcoin holdings. The ratio has fallen from over 8x in June to about 2x in recent weeks.

The drop increases the risk of dilution for shareholders if the company issues large amounts of new stock. It also reflects reduced market confidence in Metaplanet’s ability to sustain its Bitcoin-focused model.

Despite these difficulties, Metaplanet has received recognition in equity markets. The firm was upgraded from a small-cap to a mid-cap stock in FTSE Russell’s September 2025 Semi-Annual Review.

As a result, Metaplanet gained entry into the FTSE Japan Index. The upgrade followed the company’s second-quarter results, which had previously shown strong performance before the recent share decline.