El Salvador has split its Bitcoin reserve of 6,274 BTC, valued at $678 million, into 14 Bitcoin wallets. Blockchain data confirmed the onchain transfers on Friday.

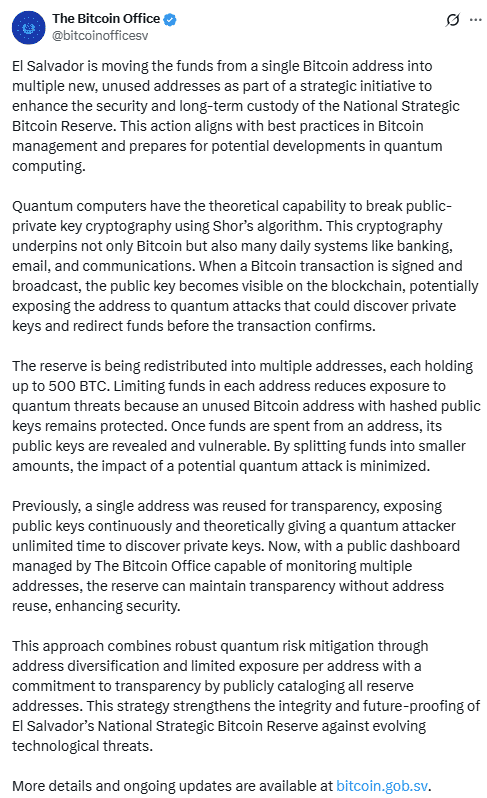

The country’s Bitcoin Office said on X that the redistribution aims to reduce exposure to quantum risk. Each wallet now holds no more than 500 BTC, lowering the chance of a large loss if cryptographic protections are ever broken.

Previously, El Salvador stored the entire Bitcoin reserve in a single address. Moving funds into multiple wallets adds an extra layer of security.

Public Keys and Quantum Risk Explained

The Bitcoin Office explained that when Bitcoin is spent from an address, its public key becomes visible. If quantum computers become powerful enough to break elliptic curve cryptography (ECC), exposed public keys could reveal private keys.

This could allow attackers to move funds. By spreading holdings across several Bitcoin wallets, the impact of such an attack would be reduced.

Research firm Project Eleven warned in April that more than 6 million BTC, worth about $650 billion, could be at risk if ECC is cracked.

Experts Say Quantum Computing Still Limited

While El Salvador acted to protect its Bitcoin reserve, many experts see the current quantum risk as low. A Bitcoin private key uses 256 bits of security. No quantum computer has managed to break even a 3-bit key using Shor’s algorithm.

Michael Saylor, architect of Strategy’s Bitcoin playbook, said in June that the issue is overstated.

“The answer is: Bitcoin network hardware upgrade, Bitcoin network software upgrade, just like [how] Microsoft, Google, the US government upgrade,”

Saylor explained.

Developers and hardware makers could introduce countermeasures if quantum risk ever becomes serious.

IMF Deal and El Salvador’s Bitcoin Policy

The transfers happened while El Salvador continues to face questions over its Bitcoin strategy. In July, the International Monetary Fund (IMF) reported that El Salvador had not made new Bitcoin purchases since February.

The country’s Bitcoin Office did not directly respond to the IMF claim but has kept posting about purchases on X.

In December 2024, El Salvador agreed to a $1.4 billion IMF deal. The agreement required the government to scale back some Bitcoin initiatives in return for funding. However, the actual terms remain disputed, with the country still maintaining a visible Bitcoin reserve.

Blockchain Data Shows Transfers Complete

Data from Mempool.space confirmed the transfers of El Salvador Bitcoin reserves. Each new Bitcoin wallet received no more than 500 BTC, matching the official explanation.

This adjustment marks a shift in how El Salvador manages its Bitcoin reserve. The redistribution highlights ongoing discussions about quantum risk, cryptographic security, and the country’s position between Bitcoin adoption and IMF conditions.