Ledn refinanced its $50 million Bitcoin loan with Swiss crypto bank Sygnum, the companies confirmed on Wednesday. The facility, which matches Ledn’s 2024 syndicated loan, was twice oversubscribed.

An oversubscribed loan means investors requested more than the available allocation. This often results in reduced participation for some investors, or the possibility of a loan increase. In this case, the oversubscription signaled heightened institutional demand for Bitcoin-backed loans.

The refinancing also indicates that large investors continue to allocate capital toward Bitcoin loan products that generate stable yields. The companies said demand for these loans reflects interest in instruments designed to hold value in an inflationary environment.

Tokenization of Bitcoin Loan Facility

A portion of the Bitcoin loan facility was tokenized through Sygnum’s Desygnate platform, which issues private credit products as onchain investments. This enabled the loan to reach a broader set of qualified investors.

Tokenization allows private credit to be transferred and recorded on blockchain systems. This process improves access, increases transparency, and provides programmable features for financial contracts. The use of Desygnate demonstrates how Bitcoin loans can be packaged as tokenized securities for institutional portfolios.

By adding tokenization, the Ledn and Sygnum loan fits within the growing tokenized private credit market. The companies said this structure allows institutional investors to gain exposure to Bitcoin loan products through regulated investment channels.

Rising Demand for Bitcoin Loan Yields

The oversubscription highlights a wider shift toward Bitcoin loan yield products. Investors are moving into this market as yields across traditional fixed income and decentralized finance decline.

In early 2025, DeFi analytics firm Neutrl reported stablecoin APRs had fallen below 6%. This drop marked a sharp contrast with the double-digit returns available during earlier market cycles before the 2022 downturn.

Amid declining yields, demand for Bitcoin-backed loans and tokenized private credit has grown. Other companies have expanded into the same area. In January, Coinbase relaunched Bitcoin loan services in the United States, supported by Morpho Labs. In July, Twenty One Capital, backed by Cantor Fitzgerald, explored US dollar loans secured by Bitcoin collateral. Reports also indicated JPMorgan Chase is reviewing Bitcoin loan products for a potential launch in 2026.

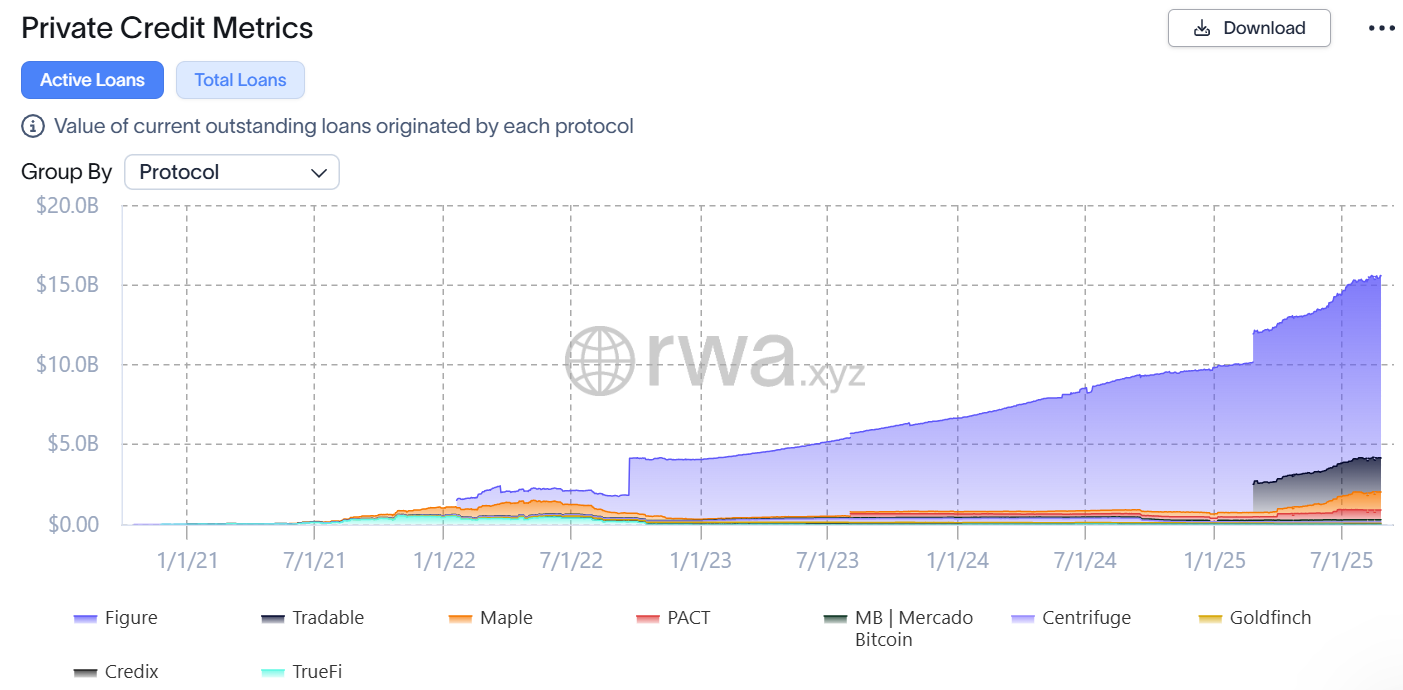

Tokenized Private Credit Market Data

The tokenized private credit market has become the largest segment of asset tokenization. As of Wednesday, it was valued at $15.6 billion, representing 58% of the onchain tokenized real-world asset market, according to RWA.xyz.

A report from Galaxy Digital in April described onchain private credit as resting on “tokenization, programmability, utility, and yield expansion.” These factors explain why tokenized private credit remains a central focus for blockchain finance.

Typical yields in tokenized private credit range from 8% to 12%, according to a June analysis by DeFi protocol Gauntlet and RWA.xyz. Retail-focused lending products fall outside this category, but institutional Bitcoin loans and tokenized credit facilities continue to dominate activity.

The Ledn and Sygnum Bitcoin loan refinance shows how tokenization is reshaping private credit, with institutional investors driving demand for secured Bitcoin lending products.