Digital Asset raised $135 million to expand its Canton Network and support the tokenization of real-world assets (RWAs). The company announced the funding round on June 24, 2025, with investors including Goldman Sachs, Citadel Securities, BNP Paribas, and the Depository Trust & Clearing Corporation (DTCC).

The round was led by DRW Venture Capital and Tradeweb Markets. Crypto-sector participants included Paxos, Polychain Capital, and Circle Ventures. The company said the capital will help scale its blockchain infrastructure and integrate billions in real-world assets.

The Canton Network is a permissionless layer-1 blockchain. It includes privacy controls and supports institutional compliance. The funds will be used to expand its reach in traditional and decentralized finance.

Digital Asset did not reply to media inquiries at the time of publication.

Canton Network Pilots With Institutional Players

Digital Asset launched the Canton Network in May 2023 with firms including Microsoft, Goldman Sachs, and Deloitte. Since its launch, the blockchain has handled several pilots with major financial institutions.

In September 2024, Digital Asset and DTCC completed a pilot involving U.S. Treasury collateral. This project used the Canton Network to test settlement operations for government bonds.

A second major test followed in October 2024, involving Euroclear, the World Gold Council, and Clifford Chance. This pilot focused on tokenizing gold, Eurobonds, and gilts. The goal was to explore secure blockchain-based asset handling.

By March 2024, the Canton Network had processed over 350 simulated transactions. These included tokenized assets, fund registries, digital cash, repo, securities lending, and margin management. Participants included 15 asset managers, 13 banks, 4 custodians, 3 exchanges, and Paxos.

Tokenization of Real-World Assets Gains Momentum

Digital Asset’s CEO Yuval Rooz said the network already supports several asset types, including bonds and alternative funds. He stated that the new funds will help expand real-world asset tokenization across more use cases.

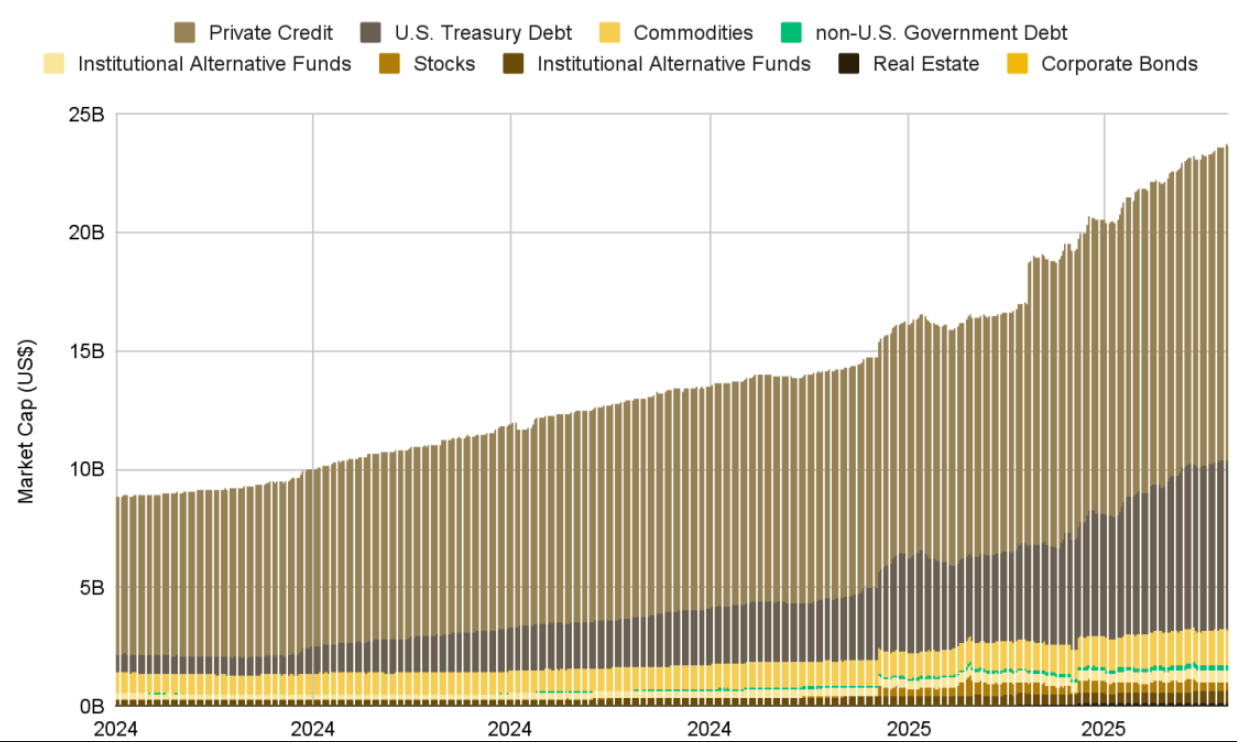

The RWA market grew over 260% in the first half of 2025, reaching a total value above $23 billion, according to Binance Research.

In June 2025, Alchemy Pay entered the RWA tokenization sector through a partnership with Backed. The collaboration enabled access to tokenized U.S. investment products.

Also this month, Guggenheim extended its digital commercial paper program in a deal with Ripple. This made the firm’s fixed-income product available on the XRP Ledger.

Institutional Interest in Canton Network and RWA Tokenization Grows

The recent $135 million investment highlights rising institutional interest in RWA tokenization and blockchain-based infrastructure. The Canton Network’s design supports regulatory compliance and data privacy, addressing key requirements for financial institutions.

The network already hosts pilots involving precious metals, government bonds, and private funds, helping to test large-scale asset tokenization. Its use of distributed ledger technology aligns with ongoing shifts in how financial markets manage custody, settlement, and fund tracking.

With backing from both Wall Street firms and crypto companies, the Canton Network remains one of the active platforms pushing real-world assets onto blockchains under institutional conditions.