Mastercard has expanded its cryptocurrency services by allowing 150 million merchants to accept payments in stablecoins. It announced collaborations with crypto exchange OKX, payment processor Nuvei, and stablecoin issuers Circle and Paxos to create an ecosystem where consumers can spend stablecoins via traditional cards and merchants can receive payments in stablecoins. With this offering, Stablecoins could experience increased demand as they become usable for everyday transactions beyond trading environments.

As part of this effort, Mastercard and OKX are launching the OKX Card, which will enable stablecoin holders to use their funds at merchant locations worldwide that accept Mastercard. In addition, Mastercard introduced a new service called Mastercard Move, allowing users to withdraw stablecoins into their bank accounts.

The company has previously partnered with Kraken, Binance, Crypto.com, and Bybit to launch crypto-enabled debit cards. Mastercard also collaborated with crypto wallet provider MetaMask and infrastructure companies like Bleap and Argent to support crypto payments via smart contracts and integrated systems. These efforts are designed to facilitate faster, more secure digital transactions with processing speeds under five seconds.

Regulatory Support Encourages Wider Crypto Adoption

Mastercard’s move into stablecoin payments follows regulatory clarity around digital assets. Earlier this month, the U.S. Securities and Exchange Commission (SEC) clarified that certain dollar-pegged stablecoins are not classified as securities. However, the SEC did not provide a definitive position regarding yield-bearing or algorithmic stablecoins.

In parallel, U.S. lawmakers introduced the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), aimed at creating a legal framework for stablecoin regulation. The bill passed a Senate committee vote in March and is advancing toward potential enactment.

Mastercard cited the evolving regulatory landscape as a key factor supporting the expansion of stablecoin-based payment solutions. The company noted that stablecoins are moving beyond trading uses and are becoming tools for payments, disbursements, and remittances.

Stablecoin Market Growth Encourages Mainstream Integration

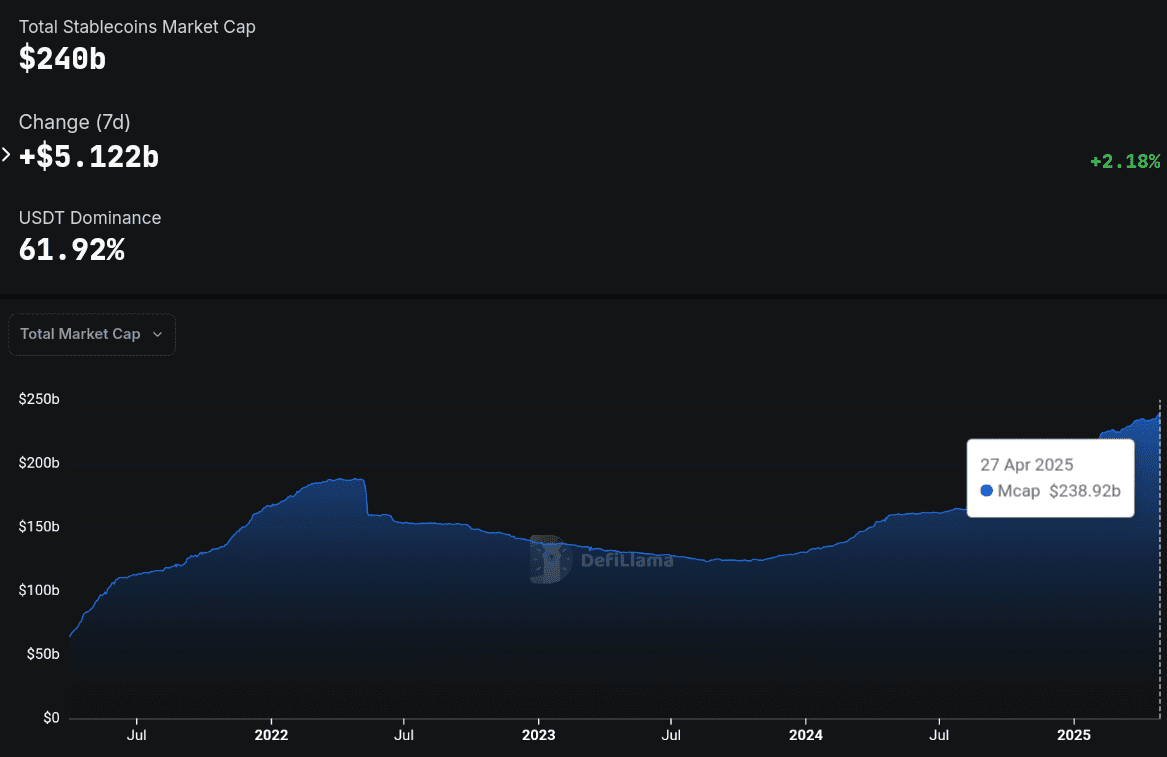

The expansion of Mastercard’s crypto offerings coincides with substantial growth in the stablecoin market. The total value of stablecoins has exceeded $239 billion, an increase of 54% over the past year. Tether (USDT) and USD Coin (USDC) continue to dominate, accounting for approximately 90% of the market share.

Additionally, active stablecoin wallets have risen by more than 50% over the last year. Bitwise analysts also estimated that stablecoins facilitated over $5.1 trillion in global transactions during the first half of 2024.

Forecasts from major financial institutions suggest further growth. Citigroup predicted the stablecoin market could expand to $3.7 trillion by 2030, while Standard Chartered Bank projected a $2 trillion market size within three years if legislative support strengthens.