NOIDA (CoinChapter.com) — Ripple’s XRP price has failed to keep pace with the broader market recovery, showing minimal volatility over the past three days. While Bitcoin and Ethereum price continued to push higher amid improving macro conditions and renewed institutional inflows, XRP remained range-bound near the $2.20 mark.

In contrast, Bitcoin surged above $94,000 earlier this week, marking its highest level in over a month. Ethereum also advanced past $1,800 before settling slightly lower. Risk appetite has returned to the market following a decline in Treasury yields and renewed enthusiasm around digital assets.

Solana and Avalanche have already posted double-digit gains in the past week, reflecting a rotation into high-beta altcoins.

However, XRP has largely stayed on the sidelines. Technical indicators show resistance near the $2.30 region, while support has formed closer to $2.00. The lack of sustained momentum suggests traders remain cautious, likely due to lingering regulatory risks and a lack of major ecosystem updates. The recent XRP Ledger security issue might have played a part in diminishing the bullish prospects for the Ripple token, but new developments might help restart the rally.

CME and Coinbase Futures Launch Could Reignite XRP and Ripple Momentum

Thanks to a wave of institutional developments, Ripple’s XRP token could soon break out of its subdued price action. The CME Group, one of the world’s largest derivatives exchanges, recently announced plans to launch XRP futures contracts on May 19, 2025.

The new futures will include micro (2,500 XRP) and standard (50,000 XRP) contracts, cash-settled and tied to the CME CF XRP-Dollar Reference Rate. This move marks a major milestone for Ripple and XRP price prospects, signaling deeper acceptance of the Ripple ecosystem among institutional players.

The introduction of regulated futures has historically served as a catalyst for crypto assets. Bitcoin’s futures launch in 2017 triggered a massive speculative rally. A similar scenario could unfold for XRP price, as hedge funds, asset managers, and sophisticated investors gain new, compliant access points to the Ripple token.

Increased futures trading activity could also enhance market liquidity, reduce volatility, and make XRP a more attractive vehicle for broader investment strategies. Coinbase Derivatives’ recent approval from the Commodity Futures Trading Commission to list XRP futures further strengthens this bullish backdrop.

It highlights the growing appetite for Ripple-related products within regulated U.S. markets, a shift that could draw significant inflows into XRP price action over the coming months. However, XRP’s rally faced immediate headwinds.

A recently reported security vulnerability in the XRP Ledger ecosystem briefly shook investor confidence, leading to a temporary pause in upside momentum. The incident served as a reminder of the challenges the Ripple token faces in maintaining trust among a rapidly expanding user base.

Overall, the twin developments from CME Group and Coinbase offer a much-needed boost to XRP price and Ripple’s broader institutional narrative, setting the stage for a potential breakout if XRP price can sustain momentum.

Muted Breakout Raises Doubts Price Momentum

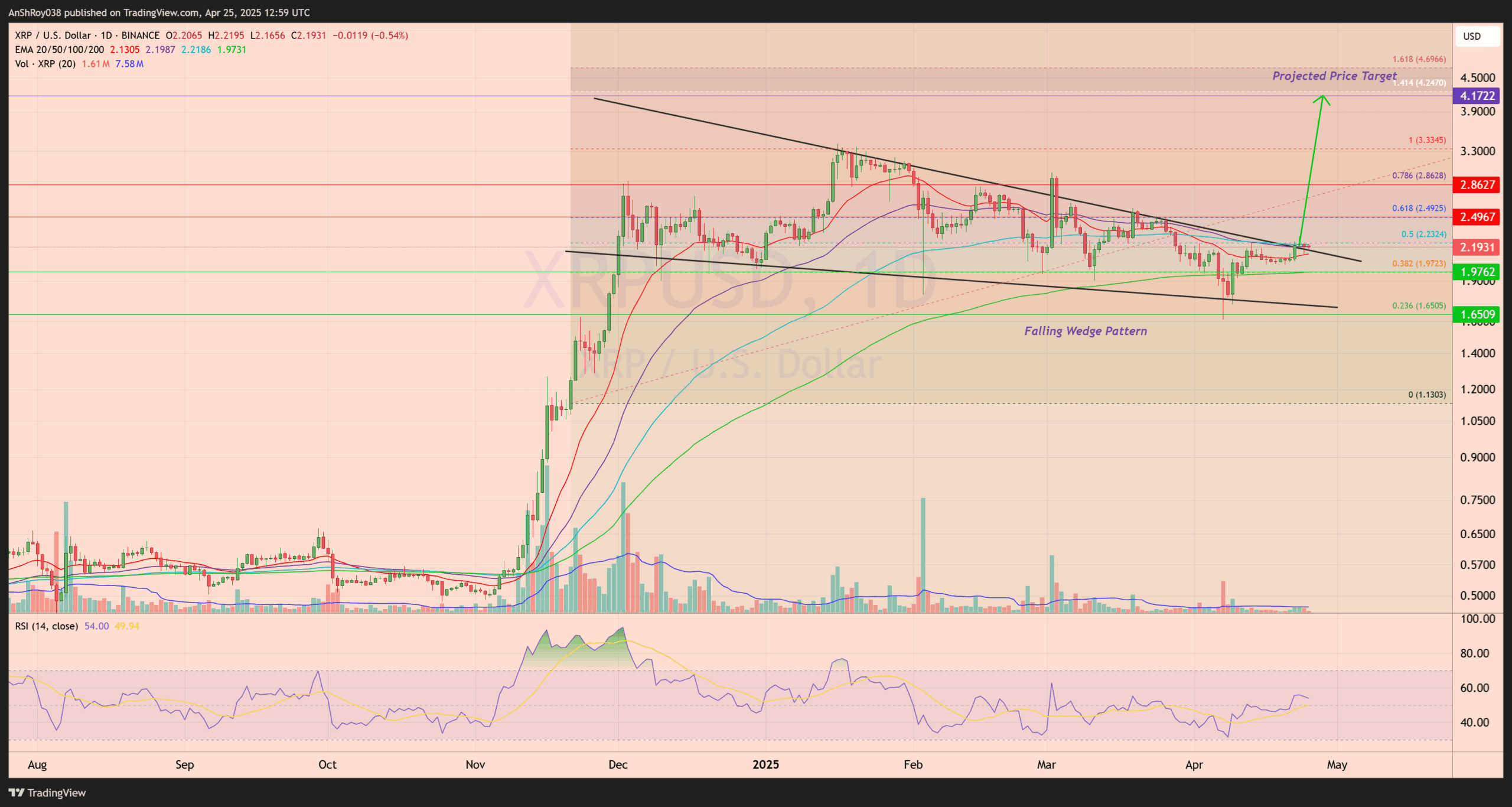

Despite growing optimism from CME and Coinbase futures announcements, XRP price action continues to struggle with technical confirmation. The token recently broke out of a falling wedge pattern on the daily timeframe, typically considered a bullish reversal structure.

The wedge had formed over multiple months and was characterized by two descending, converging trendlines connecting lower highs and lower lows. This setup often signals waning selling pressure and a potential shift toward upward momentum.

However, the breakout has so far failed to deliver the expected follow-through. XRP price briefly surged past the upper boundary of the wedge, reaching a local high near the $2.22–2.23 zone. But the move quickly lost steam, with immediate rejection emerging just under the 100-day EMA (blue), now acting as dynamic resistance.

That EMA, currently hovering near $2.21, has capped price advances for the past three sessions, signaling the absence of strong bullish conviction. Breaking past the EMA resistance would bring XRP price close to the 0.618 Fib retracement level resistance near $2.5. A further move above could open the path toward the $2.86 barrier. Beyond that, the next resistance stands near $3.33

On the downside, XRP’s short-term support is near $1.97, with the next major support zone near $1.65. Failure to hold above $1.97 would put XRP back inside the wedge structure, weakening bullish momentum and raising the probability of a deeper correction.

The Relative Strength Index remains near the neutral 54 mark, offering no clear bullish divergence. This combination of weak momentum and persistent resistance increases the probability of a failed breakout—or fakeout—rather than a confirmed trend reversal.