YEREVAN (CoinChapter.com) — Asset manager Teucrium Investment Advisors will launch the first XRP-based ETF in the U.S. on April 8. The new product, named Teucrium 2x Long Daily XRP ETF, will trade under the ticker XXRP on NYSE Arca.

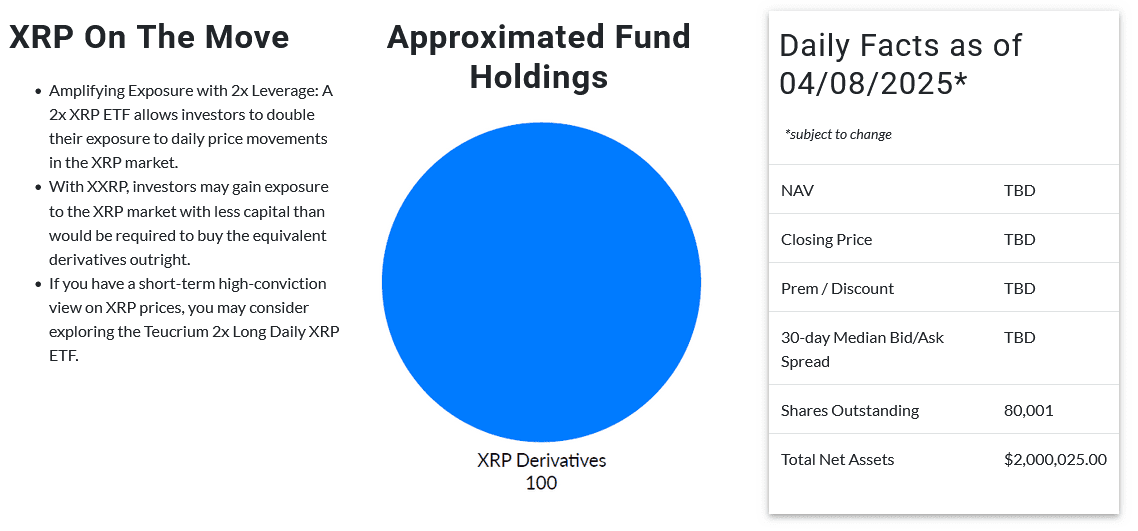

The XRP ETF XXRP is designed to offer 2x daily exposure to the performance of the XRP token. The management fee is 1.85%, and the fund’s initial net assets stand at $2 million, as stated on Teucrium’s website.

The product will not offer long-term exposure. Instead, it targets short-term traders looking for leveraged returns linked to XRP’s daily price movement.

Teucrium’s Shift From Commodities to Crypto ETFs

Founded in 2010, Teucrium is known for offering ETFs based on agricultural commodities like corn, soybeans, sugar, and wheat. With this new listing, the firm is moving into the crypto sector for the first time.

Teucrium CEO Sal Gilbertie spoke to Bloomberg on April 7, confirming increased interest in an XRP ETF. He also said the company may explore more crypto-related ETF filings later. Gilbertie mentioned the timing of this listing is during a market downturn impacted by Donald Trump’s tariffs.

He said,

“What better time to launch a product than when prices are low?”

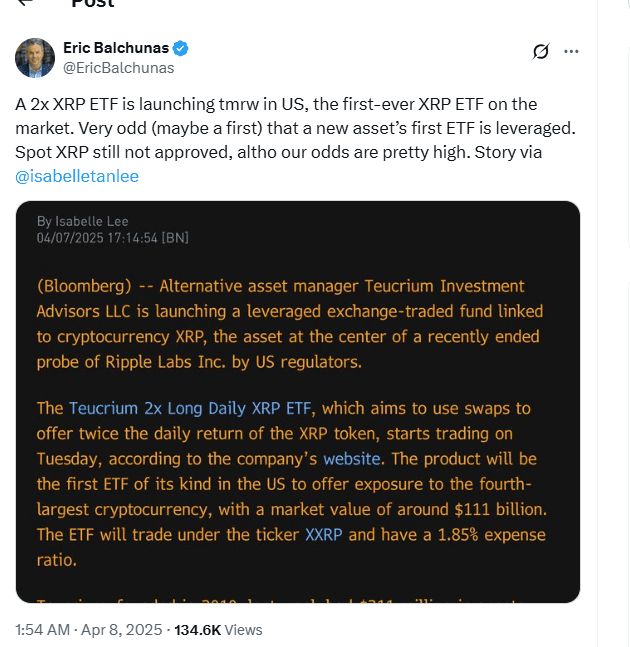

Bloomberg ETF analyst Eric Balchunas described it as unusual to see a new asset class open with a leveraged ETF. However, he noted the high probability of a spot XRP ETF being approved in the future.

Balchunas and his colleague James Seyffart estimated a 65% chance of spot XRP ETF approval in 2025. The forecast aligns with Polymarket’s current figure of 75%.

The Securities and Exchange Commission (SEC) is now reviewing several spot XRP ETF applications. The applicants include Grayscale, Bitwise, Franklin Templeton, Canary Capital, and 21Shares.

Ripple-SEC Case Closed, ETF Environment Changes

The legal battle between Ripple Labs and the SEC over XRP’s security status ended last month. That case had delayed several XRP ETF applications in past years. Now that the case is resolved, the ETF environment has shifted. Teucrium is among the first to respond with a public listing tied to XRP’s daily price. Before this, ETF issuers faced restrictions due to unclear regulatory treatment of XRP. The end of the court case has changed those conditions.

NYSE Arca will host the new XRP ETF XXRP starting April 8, with visibility via its assigned ticker. Performance will reflect short-term moves in XRP’s value, not long-term asset growth.

As of now, Teucrium manages over $310 million in total assets, mostly in commodity-focused ETFs. The launch of XRP ETF XXRP places the firm into the crypto ETF market at a time of changing regulation and investor interest.