YEREVAN (CoinChapter.com) — The U.S. Securities and Exchange Commission (SEC) has delayed its decision on whether to approve Ether ETF options on Cboe Exchange. According to a Feb. 28 regulatory filing, the agency has set May 2025 as the new deadline for a final ruling.

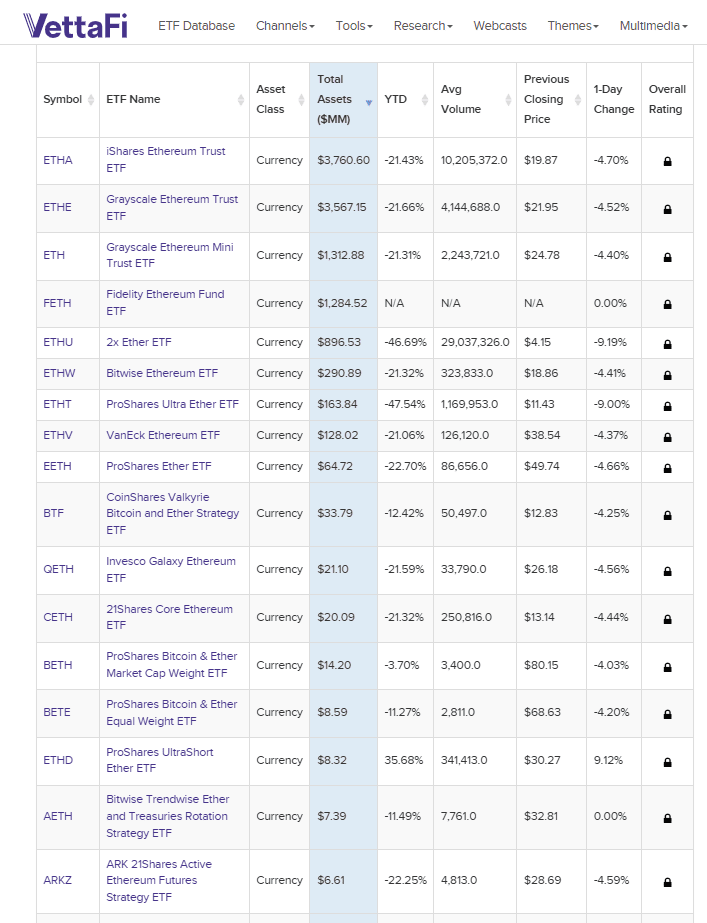

Cboe initially submitted its request in August 2024, seeking approval to list options on the Fidelity Ethereum Fund (FETH). The SEC extended its review period in October 2024, stating it needed additional time. FETH is among the largest Ether ETFs, managing approximately $1.3 billion in net assets, based on data from VettaFi.

SEC Also Delays BlackRock’s Ether ETF Options Approval

The SEC has also postponed its decision on Nasdaq ISE’s request to list options for BlackRock’s iShares Ethereum Trust (ETHA). The agency plans to issue a ruling by April 2025.

BlackRock’s fund is the largest Ether ETF, holding over $3.7 billion in net assets, according to VettaFi data. The SEC’s approach to Ether ETF options contrasts with its handling of Bitcoin ETF options, which began trading in November 2024.

Spot Ether ETFs Continue to Attract Investments

Although Ether ETF options face regulatory delays, spot Ether ETFs have seen steady growth. Since launching in July 2024, these funds have attracted $11 billion in net assets, based on VettaFi figures.

Options allow traders to enter contracts granting the right to buy or sell an asset at a predetermined price. Many investors use options on Ether ETFs for risk management and market exposure.

Crypto ETF Options Market Expands

The demand for crypto ETF options has increased with the rise of institutional participation. On the first day of trading in November 2024, Bitcoin ETF options for BlackRock’s iShares Bitcoin Trust ETF (IBIT) saw $2 billion in exposure.

Meanwhile, crypto futures markets continue to grow. On Feb. 19, Coinbase introduced Solana (SOL) futures. The Chicago Mercantile Exchange (CME) Group announced plans to launch SOL futures contracts on March 17, pending regulatory approval.

Political Developments and Crypto Regulations

Changes in financial regulation could affect crypto ETF options. Former U.S. President Donald Trump has stated that he wants the country to become a “crypto capital” and has appointed crypto-friendly leaders to financial regulatory positions.

The SEC continues to assess applications for Ether ETF options, while institutions monitor developments in crypto derivatives markets.